The On-Line Calculation fields are as i)Agriculture ii) Aircraft iii)General Math iv)Physics v)Chemistry vi)Chemical Engg. vii)Civil Engg. viii)Mechanical Engg. ix)EEC Engg. x) Fisheries Engg. xi) Poultry Engg. xii) Merine Engg. xiii) Nuclear Engg. xiv) Accounting and Finance. and many more. They assist Students, engineers, and researchers in analyzing and optimizing their regular work. It is the Blogpost for continuous use and I am requesting you to share as much as you can.

Donate for the Poorest Students

You can support for the poorest students. Copy the link in your browser & Donate as small as possible..

https://www.paypal.com/donate/?hosted_button_id=R3MNE48JU7KGL

Wednesday, 21 June 2023

Date calculator:Calculators for Students, Engineers & Researchers:free Online Tool

Date Calculator

Age Calculator:Calculators for Students, Engineers & Researchers:free Online Tool

Definition: You can input your date of birth or any specific date you want to calculate with respect to present date and click a button to calculate your age in various units.Like Years, Months, Weeks, Hours, Minutes,Seconds,Miliseconds, Microseconds.

Age Calculator

This post will create a simple web page where you can input your date of birth or any specific date you want to calculate with respect to present date and click a button to calculate your age in various units. Like Years, Months, Weeks, Hours, Minutes,Seconds,Miliseconds, Microseconds.

Calculating age serves several purposes in various contexts, and its usefulness and benefits extend to different aspects of life:

1. **Personal Milestones and Planning**: Age calculation helps individuals track their personal milestones such as birthdays, anniversaries, and other significant events. It allows people to plan their lives, set goals, and make decisions related to education, career, retirement, and healthcare based on their age.

2. **Legal and Regulatory Compliance**: Age is often a determining factor in legal matters, including eligibility for voting, driving, consuming alcohol, and getting married. It also affects eligibility for certain government benefits, social services, and retirement plans. Calculating age ensures compliance with relevant laws and regulations.

3.Healthcare and Wellness: Age plays a crucial role in healthcare, as it influences factors such as disease risk, treatment options, and preventive care. Healthcare professionals use age calculations to assess patients' health status, determine appropriate screenings and vaccinations, and manage chronic conditions effectively.

4. **Financial Planning and Insurance**: Age affects various financial aspects, including insurance premiums, retirement savings, and investment strategies. By accurately calculating age, individuals can make informed decisions about purchasing insurance policies, planning for retirement, and managing their finances to achieve long-term goals.

5. **Education and Development**: Age is a key factor in educational settings, as it determines grade levels, school admissions, and eligibility for academic programs. Age calculations help educators tailor teaching methods and curricula to suit students' developmental stages and learning needs.

6. **Employment and Career Development**: Age often influences employment decisions, such as hiring, promotions, and retirement. Job seekers use age calculations to highlight their experience and qualifications, while employers consider age-related factors when recruiting and managing workforce diversity.

How to Earn money through age calculation:

1. **Consulting Services**: You can offer consulting services to businesses, organizations, and individuals on age-related matters such as retirement planning, healthcare strategies for different age groups, and age-inclusive workplace policies.

2. **Software Development**: Develop software applications or tools that facilitate age calculations for specific purposes, such as age verification for online services, age-based financial planning calculators, or healthcare management platforms tailored to different age demographics.3.

**Data Analysis and Research**:Conduct demographic analysis and research studies using age-related data to identify trends, patterns, and market opportunities. You can sell research reports or provide customized data analysis services to companies, government agencies, and academic institutions.

4. **Training and Workshops**: Offer training programs, workshops, or online courses on topics related to age calculation, age-sensitive communication, and age diversity awareness. Target organizations, HR professionals, healthcare providers, and educators seeking to enhance their understanding and practices related to age.

5. **Content Creation and Publishing**:Create educational content, blogs, ebooks, or videos focusing on age-related topics, such as healthy aging, age-appropriate lifestyle choices, and age-based career planning. You can monetize your content through advertising, subscriptions, or selling digital products.

6. **Event Planning and Hosting**:Organize events, seminars, or conferences centered around age-related themes, such as aging well, intergenerational collaboration, or age-friendly initiatives. Generate revenue through ticket sales, sponsorships, and partnerships with relevant stakeholders.

By leveraging age calculation in these ways, you can provide valuable services, products, and solutions that address the diverse needs and interests of individuals and organizations across different sectors and industries worldwide.

Sales tax calculator:Calculators for Students, Engineers & Researchers:free Online Tool

Definition: Sales tax is a consumption tax levied by a governing body on the sale of certain goods and services within their jurisdiction. It's typically a percentage of the retail price of the item and is added to the final cost at the point of purchase.

Click the Translate button(see right) on this post to set your Own Language to understand more perfectly!!Sales Tax Calculator Sales Tax Calculator

Definition Continue:Sales Tax ExplainedSales tax is a consumption tax levied by a governing body on the sale of certain goods and services within their jurisdiction. It's typically a percentage of the retail price of the item and is added to the final cost at the point of purchase.Properties of Sales Tax:Consumption Tax: It's a tax on spending, meaning it falls on the final consumer who purchases the good or service. Indirect Tax: The seller collects the tax from the customer and then remits it to the government. The seller doesn't directly pay the tax themselves.Varies by Location: Sales tax rates can differ significantly between states, counties, and even cities within the same state. Some states don't have a statewide sales tax, while others have additional local sales taxes on top of the state rate.Exemptions: Certain goods and services may be exempt from sales tax, such as groceries, medicine, or educational materials. These exemptions vary by jurisdiction.Calculating Sales Tax (Simple Case)There's no complex equation to calculate sales tax for a single purchase. Here's the basic formula:Sales Tax Amount = Sales Price x Sales Tax RateExample:Let's say you buy a shirt for $20.00 in a location with a 7% sales tax rate.Sales Tax Amount = $20.00 (price) x 7% (tax rate) = $1.40The total cost of the shirt, including sales tax, would be $20.00 (price) + $1.40 (sales tax) = $21.40Additional Notes:In some cases, sales tax might be calculated on a tiered basis, meaning different tax rates apply to different categories of goods.Online retailers may need to collect sales tax based on the customer's shipping address, not necessarily the retailer's location.Understanding sales tax is important when budgeting for purchases, as it can significantly impact the final price you pay. You can find the specific sales tax rate for your location on the government website or by asking the retailer.How can we earn money using this knowledge of Sales Tax calculation in the real world?While directly earning money through sales tax calculation isn't typical, understanding it can benefit you in several ways:1. More Accurate Budgeting and Saving:blockquote>Knowing the sales tax rate in your area allows for more precise budgeting. By factoring in the sales tax when estimating expenses, you'll avoid surprises at checkout and potentially save money by sticking to your budget.

2. Identifying Sales Tax Errors:

Occasionally, stores might miscalculate sales tax on your purchase. With your understanding of the sales tax rate, you can identify potential errors on your receipt and politely bring them to the cashier's attention. This can save you money if they've overcharged you.

3. Taking Advantage of Tax-Free Holidays:

Many states and localities offer tax-free holidays on specific items or categories throughout the year. Knowing the sales tax rate and these tax-free periods allows you to strategically plan your purchases and maximize your savings.

4. Online Shopping and Sales Tax:

Sales tax laws for online purchases can be complex. Understanding how sales tax applies to online purchases based on your location and the seller's location can help you avoid unexpected tax charges or ensure you're paying the correct amount.

5. Business Applications (Indirect Earning):

If you run a small business that sells taxable goods or services, understanding sales tax is crucial. You'll need to calculate, collect, and remit sales tax to the government. While this doesn't directly earn you money, it ensures you comply with tax regulations and avoid penalties.

Additionally, accurate sales tax calculation helps you set proper pricing for your products or services to account for the final cost to the customer.

By being familiar with sales tax calculations, you can become a more informed consumer and potentially save money on your purchases. In the case of businesses, proper sales tax handling is essential for legal and financial compliance.

Do YOU Want To Earn Money In Various Ways, Click The Link & Explore Your Field of Interest!!!

Salary Calculator.:Calculators for Students, Engineers & Researchers:free Online Tool

Definition: Salary typically isn't directly calculated from an hourly rate because salaried employees receive a fixed amount regardless of the hours worked within a standard workweek. However, we can estimate a salaried position's equivalent hourly rate if we know some additional details.

Click the Translate button(see right) on this post to set your Own Language to understand more perfectly!!

Salary Calculator

Continue Definition:

Salary typically isn't directly calculated from an hourly rate because salaried employees receive a fixed amount regardless of the hours worked within a standard workweek. However, we can estimate a salaried position's equivalent hourly rate if we know some additional details.

Salary Based on Hourly Rate (Estimation)

While there's no perfect formula to convert salary to hourly rate or vice versa, we can estimate an hourly equivalent for salaried positions using this approach:

Estimated Hours: We need to consider the expected number of hours worked per week in the salaried position. This may not be explicitly stated but often falls around 40 hours per week (standard workweek).

Total Weeks Worked: In a year, there are typically 52 weeks. However, some salaried positions may exclude paid time off (PTO) weeks, so this might need adjustment based on the specific job details.

Estimation Formula

Here's a simplified formula to estimate an hourly equivalent for a salary:

Estimated Hourly Rate = Annual Salary / (Estimated Hours per Week * Total Weeks Worked per Year)

Example

Let's say John is a marketing manager with a yearly salary of $72,000. Considering a standard workweek of 40 hours and assuming he receives 2 weeks of paid time off, we can estimate his hourly equivalent:

Estimated Hours per Week = 40 hours

Total Weeks Worked (adjusted for PTO) = 52 weeks - 2 weeks = 50 weeks

Estimated Hourly Rate = $72,000 / (40 hours/week * 50 weeks/year)

Estimated Hourly Rate = $72,000 / 2000 hours = $36 per hour (This is an estimate, actual pay may differ based on overtime or other factors)

Important Points

This is an estimated hourly rate, not the actual pay per hour. Salaried employees don't receive extra pay for working more than the expected hours within the workweek.

Overtime policies for salaried positions can vary. Some may be exempt from overtime pay regulations, while others may receive overtime pay for exceeding a certain number of hours.

Understanding this estimation method can help you compare salaried positions with hourly wage jobs or get a general sense of the hourly value of a salaried position. However, remember, a salary offers a fixed income and often comes with benefits like health insurance, which can be valuable considerations beyond just the hourly equivalent.

How it is possible to earn money using this knowledge of Salary calculation in our real world???

Knowledge of salary calculation can be helpful in various real-world scenarios where you need to assess the value of your work or compare different job offers. Here are some examples:

Negotiating your salary: When applying for a new job, understanding how salary is calculated can help you estimate a fair salary range for the position based on factors like your experience, education, and the prevailing market rate. You can use the equivalent hourly rate calculation to compare salary offers that are structured differently (e.g., hourly vs. salary).

Freelance work: If you work as a freelancer, you can use your understanding of salary calculation to set your hourly or project rates. Consider factors like the complexity of the work, your experience level, and your desired income when setting your rates.

Comparing job offers: When evaluating multiple job offers, consider not just the base salary but also the benefits package and other forms of compensation. You can use the equivalent hourly rate calculation to compare offers that include different benefits packages.

Understanding your worth: Knowing how to calculate your equivalent hourly rate can help you understand the value of your time and expertise. This can be useful in various situations, such as negotiating a raise, deciding whether to take on a side hustle, or evaluating a job offer.

In essence, by understanding salary calculations, you can make informed decisions about your career path and ensure you are fairly compensated for your time and skills.

Here's an example of how you can use the equivalent hourly rate calculation in practice:

Let's say you are considering a job offer for an annual salary of $78,000. The job description mentions a standard workweek of 40 hours and 2 weeks of paid time off. You can use the following formula to estimate the equivalent hourly rate:

In this example:

Annual salary = $78,000

Estimated hours per week = 40

Paid time off weeks = 2

Total weeks worked per year = 52 weeks - paid time off weeks = 50 weeks

Estimated hourly rate = $78,000 / (40 hours/week * 50 weeks/year) = $39.00 per hour

By calculating your equivalent hourly rate, you can gain a better understanding of the compensation being offered and compare it to other job offers or your current salary. This information can be helpful in salary negotiations or deciding if the job offer is a good fit for you financially.

Do YOU Want To Earn Money In Various Ways, Click The Link & Explore Your Field of Interest!!!

Compound interest calculator:Calculators for Students, Engineers & Researchers:free Online Tool

Definition: Compound interest is interest earned on both the initial principal amount (the money you invest or borrow) and the accumulated interest from previous periods. In simpler terms, it's "interest on interest." This means your money grows at an accelerated rate over time compared to simple interest, where interest is only calculated on the initial principal.

Click the Translate button(see right) on this post to set your Own Language to understand more perfectly!!

Compound Interest Calculator

Continiue Definition:

Compound Interest

Compound interest is interest earned on both the initial principal amount (the money you invest or borrow) and the accumulated interest from previous periods. In simpler terms, it's "interest on interest." This means your money grows at an accelerated rate over time compared to simple interest, where interest is only calculated on the initial principal.

Properties of Compound Interest

Exponential Growth: Due to interest being earned on both the principal and prior interest, compound interest leads to exponential growth of your investment over time. The longer you invest and the more frequently interest is compounded, the greater the impact.

Impact of Interest Rate and Compounding Frequency: The higher the interest rate and the more frequent the compounding, the faster your money grows. For instance, monthly compounding will result in more interest earned compared to annual compounding for the same interest rate and time period.

Formula

The formula for calculating compound interest is:

A = P * (1 + r/n)^(n*t)

Where:

A = Final amount (including principal and interest)

P = Initial principal amount

r = Annual interest rate (as a decimal)

n = Number of compounding periods per year (e.g., 1 for annual, 12 for monthly)

t = Total number of years

Example

Let's say you invest $1,000 (principal) at an annual interest rate of 5%. You plan to keep the investment for 5 years, and the interest is compounded annually (n=1).

Using the formula:

A = $1,000 * (1 + 0.05/1)^(1*5)

A = $1,000 * (1.05)^5

A = $1,276.28

In this example, after 5 years with annual compounding, your investment would grow to $1,276.28. The total interest earned would be $276.28.

Compound interest can be a powerful tool for growing your wealth over time, especially when you start investing early and let your money compound for a long period.

How to Earn Money using Compound interest Calculation in real life with the knowledge????

Here's how you can leverage compound interest to grow your money in real life:

1. Early and Consistent Investing:

Time is your friend: The magic of compound interest lies in the extended timeframe. The earlier you start investing, the more time your money has to grow exponentially. Even small, consistent contributions can accumulate significantly over decades.

2. Utilize Interest-Bearing Accounts:

Savings Accounts: While savings accounts typically offer lower interest rates, they are a safe and accessible way to start building your habit and benefit from compound interest.

Certificates of Deposit (CDs): CDs lock your money in for a fixed term in exchange for a guaranteed interest rate, usually higher than savings accounts. The interest earned on a CD also compounds throughout the term.

Retirement Accounts: Many retirement plans like IRAs and 401(k)s offer tax advantages and often have investment options with higher potential returns compared to traditional savings accounts.

3. Invest in Assets with Growth Potential:

Stocks: Owning stocks allows you to participate in the growth of companies. While stock prices can fluctuate, historically, the stock market has provided an average return that outpaces inflation over the long term. Reinvesting your dividends allows you to benefit from compound interest on your stock holdings.

Mutual Funds and ETFs: These investment vehicles pool money from multiple investors and are managed by professionals. They offer diversification and a potentially higher growth rate than bonds or savings accounts, with compounding working on the total value of your investment in the fund.

4. Minimize Debt and Interest Charges:

High-interest debt like credit cards can quickly eat away at your potential returns. Paying off high-interest debt frees up money for investing and eliminates the negative compounding effect of interest charges.

5. Maximize Compounding Frequency:

Look for investment options with more frequent compounding periods (monthly vs. annually). This can slightly accelerate your growth over time.

Remember:

Risk and Return: Generally, higher potential returns come with higher risk. Diversification across different asset classes can help manage risk.

Investment Horizon: Match your investments to your time frame. Don't invest in volatile assets if you need the money in the short term.

Knowledge and Research: Educate yourself about different investment options before making decisions. Consider consulting a financial advisor for personalized guidance.

By understanding compound interest and implementing these strategies, you can harness its power to grow your wealth and achieve your financial goals.

Do YOU Want To Earn Money In Various Ways, Click The Link & Explore Your Field of Interest!!!

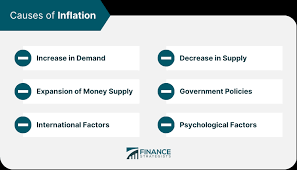

Inflatation Calculator:Calculators for Students, Engineers & Researchers:free Online Tool

Definition: Inflation refers to the general increase in the prices of goods and services in an economy over time. This means that a unit of currency, like a dollar or taka, buys you less and less as time goes by.

Inflatation Calculator

Click the Translate button(see right) on this post to set your Own Language to understand more perfectly!!

Inflation Calculator

Continue Definition:

Inflation refers to the general increase in the prices of goods and services in an economy over time. This means that a unit of currency, like a dollar or taka, buys you less and less as time goes by.

Here's a breakdown of key concepts related to inflation:

Rate of Inflation: This is the percentage increase in prices compared to a specific period, usually a year. It reflects how quickly the purchasing power of your money is declining.

Consumer Price Index (CPI): This is a common index used to measure inflation. It tracks the average price changes for a basket of goods and services that a typical consumer might buy. By comparing the CPI of one year to another, we can calculate the inflation rate.

Equation:

Inflation Rate (%) = ((CPI(current year) - CPI(previous year)) / CPI(previous year)) x 100

Example:

Let's say the CPI in 2023 was 100 and the CPI in 2024 is 105. Using the above formula, the inflation rate for 2024 would be:

Inflation Rate (%) = ((105 - 100) / 100) x 100 = 5%

This means that prices on average have increased by 5% in 2024 compared to 2023. So, with the same amount of money in 2024, you can buy 5% fewer goods and services than you could in 2023.

Properties of Inflation

Inflation has both positive and negative effects on an economy. Here's a look at its properties:

Modest Inflation: A low and steady rate of inflation (around 2-3%) is generally considered healthy for an economy. It encourages spending and investment, which can lead to economic growth.

High Inflation: When inflation spirals out of control, it can be very damaging. It reduces purchasing power, discourages saving, and creates uncertainty for businesses. In extreme cases, it can lead to hyperinflation, where prices increase rapidly, causing economic collapse.

Deflation: The opposite of inflation is deflation, where prices decrease over time. While it may seem like a good thing at first, deflation can also be harmful. It can lead to decreased spending, lower wages, and economic stagnation.

Understanding inflation is crucial for navigating the economy effectively. By knowing how inflation affects prices and your purchasing power, you can make better decisions about spending, saving, and investing.

How it is Possible to Earn Money by the calculation of Inflation????

You can't directly earn money by simply calculating inflation itself. However, understanding inflation can help you make informed financial decisions that can potentially grow your wealth or protect it from inflation's erosive effects.

Here are a couple of ways:

Investing in Inflation-Hedging Assets:

Treasury Inflation-Protected Securities (TIPS): These are U.S. government bonds where the principal value adjusts based on inflation. As inflation rises, the value of your TIPS investment goes up, protecting your purchasing power.

Commodities: These are real assets like gold, oil, or agricultural products. Their prices tend to rise with inflation as demand increases due to the declining value of currency.

Real Estate: Property values often rise over time, potentially outpacing inflation and offering a hedge against its effects. However, real estate is a complex investment with its own set of risks.

Making Investment Decisions based on Inflation:

Considering Inflation in Returns: When evaluating investment performance, you should factor in inflation. A 10% return on your investment might sound good, but if inflation is at 5%, your real return (your purchasing power gain) is only 5%.

Adjusting Investment Strategies: During periods of high inflation, you might want to shift your portfolio towards assets that tend to perform well in such environments, like TIPS or commodities.

By understanding inflation and its impact on different asset classes, you can make informed investment choices that can potentially grow your wealth and protect it from inflation's grip.

Do YOU Want To Earn Money In Various Ways, Click The Link & Explore Your Field of Interest!!!

Meter to feet and Feet to Meter conversion calculator:Calculators for Students, Engineers & Researchers:free Online Tool

Conversion Calculator

Enthalpy Calculator:Calculators for Students, Engineers & Researchers:free Online Tool

Enthalpy Measurement Calculator

Octane flow rate measurement.:Calculators for Students, Engineers & Researchers:free Online Tool

Octane Flow Measurement Calculator

Water flow rate measurement calculator:Calculators for Students, Engineers & Researchers:free Online Tool

Water Flow Measurement Calculator

Subscribe to:

Comments (Atom)

QR Code Generator:Engineering & Science Calculators: Free Online Tools.

Definition: A *QR code* (Quick Response code) is a two-dimensional barcode that stores data, like text, URLs, or other digital information, ...

-

Definition: An ellipse is the set of all points in a plane where the sum of the distances from each point to two fixed points (called foci) ...

-

Definition: A quadratic equation is a polynomial equation of the second degree, meaning it contains at least one term that is squared. Clic...