The On-Line Calculation fields are as i)Agriculture ii) Aircraft iii)General Math iv)Physics v)Chemistry vi)Chemical Engg. vii)Civil Engg. viii)Mechanical Engg. ix)EEC Engg. x) Fisheries Engg. xi) Poultry Engg. xii) Merine Engg. xiii) Nuclear Engg. xiv) Accounting and Finance. and many more. They assist Students, engineers, and researchers in analyzing and optimizing their regular work. It is the Blogpost for continuous use and I am requesting you to share as much as you can.

Donate for the Poorest Students

You can support for the poorest students. Copy the link in your browser & Donate as small as possible..

https://www.paypal.com/donate/?hosted_button_id=R3MNE48JU7KGL

Showing posts with label Calculate and Improve your Desired Goal. Show all posts

Showing posts with label Calculate and Improve your Desired Goal. Show all posts

Thursday, 6 July 2023

Propulsion System Efficiency Calculator:Calculators for Students, Engineers & Researchers:free Online Tool

Tuesday, 4 July 2023

Redox Potential Calculator:Calculators for Students, Engineers & Researchers:free Online Tool

Redox Potential Calculator

Reaction Rate Calculator:Calculators for Students, Engineers & Researchers:free Online Tool

Reaction Rate Calculator

Result

Concentration Calculator:Calculators for Students, Engineers & Researchers:free Online Tool

Concentration Calculator

Chemical Equation Balancer,:Calculators for Students, Engineers & Researchers:free Online Tool

Chemical Equation Balancer

Acid-Base Titration Calculator:Calculators for Students, Engineers & Researchers:free Online Tool

Acid-Base Titration Calculator

pH Calculator:Calculators for Students, Engineers & Researchers:free Online Tool

pH Calculator

Ideal Gas Law Calculator:Calculators for Students, Engineers & Researchers:free Online Tool

Ideal Gas Law Calculator

Stoichiometry Calculator:Calculators for Students, Engineers & Researchers:free Online Tool

Stoichiometry Calculator

Molar Mass Calculator:Calculators for Students, Engineers & Researchers:free Online Tool

Molar Mass Calculator

Flight Envelope Calculator:Calculators for Students, Engineers & Researchers:free Online Tool

Flight Envelope Calculator

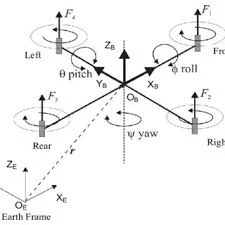

AirCraft Stability Calculator:Calculators for Students, Engineers & Researchers:free Online Tool

Definition: Aircraft stability refers to its ability to resist disturbances and return to balanced flight after encountering forces that upset its equilibrium. There are two main types of stability:Static stability: This is the initial tendency of the aircraft to react to a disturbance. A stable aircraft will generate forces and moments that push it back towards its original attitude. Dynamic stability: This describes how quickly and smoothly the aircraft returns to balanced flight after a disturbance. A dynamically stable aircraft will have a dampened response, oscillating around equilibrium before settling.

Click the Translate button(see right) on this post to set your Own Language to understand more perfectly!!

Aircraft Stability Calculator

Continue Definition:

Aircraft Stability: Maintaining Balance in Flight

Aircraft stability refers to its ability to resist disturbances and return to balanced flight after encountering forces that upset its equilibrium. There are two main types of stability:

Static stability: This is the initial tendency of the aircraft to react to a disturbance. A stable aircraft will generate forces and moments that push it back towards its original attitude.

Dynamic stability: This describes how quickly and smoothly the aircraft returns to balanced flight after a disturbance. A dynamically stable aircraft will have a dampened response, oscillating around equilibrium before settling.

Several factors influence aircraft stability, including:

Wing Area (S): A larger wing area generally increases lift, but it can also lead to a higher moment of inertia, making the aircraft slower to respond to disturbances.

Mean Aerodynamic Chord (MAC): This is the average chord length of the wing, representing its overall aerodynamic character. The distance between the center of gravity (CG) and the MAC (moment arm) affects static stability.

Wing Span (b): A larger wingspan increases roll stability by providing a greater lever arm for rolling moments.

Tail Area (S_h): The horizontal stabilizer, along with the elevator, plays a crucial role in pitch stability. The relative size of the tail compared to the wing (S_h/S) affects the restoring moment generated when the aircraft pitches.

Moment of Inertia (I): This is a measure of the aircraft's resistance to angular acceleration. A higher moment of inertia can make the aircraft slower to respond to control inputs or disturbances.

Here's an equation for calculating the static margin (SM), a key indicator of longitudinal static stability:

SM = (CG location behind MAC) / (Mean Aerodynamic Chord)

A positive static margin signifies that the center of gravity is ahead of the aerodynamic center (a point where lift forces act), leading to a restoring moment that pushes the aircraft back towards trimmed flight.

Maintaining Aircraft Stability

Aircraft stability can be maintained through several methods:

Design: The inherent design of the aircraft, including wing and tail configuration, placement of the center of gravity, and wing dihedral (an upward angle of the wingtips) all contribute to stability.

Control Surfaces: The pilot uses ailerons (roll), elevator (pitch), and rudder (yaw) to adjust the aircraft's attitude and counteract disturbances.

Flight Control Systems: Modern aircraft often have fly-by-wire systems that electronically manage control surfaces and enhance stability, especially for high-performance or unstable designs.

Pilot Technique: Skilled pilots use smooth control inputs and anticipate disturbances to maintain smooth flight.

The effects of these methods on the aircraft vary:

Increased wing area: Improves lift but can decrease maneuverability due to higher inertia.

Larger tail area: Enhances pitch stability but adds weight and drag.

Control surface deflection: Creates corrective moments but requires pilot input and can increase drag.

Fly-by-wire systems: Improve stability and handling characteristics but add complexity and reliance on technology.

Skilled piloting: Maintains smooth flight but requires experience and constant attention.

In conclusion, aircraft stability is a critical factor for safe and efficient flight. A well-designed aircraft with proper pilot technique and control systems can maintain stability despite external disturbances. Understanding the factors influencing stability and the methods for achieving it is essential for both aircraft design and pilot training.

Example:

Consider two airplanes, A and B, with the following characteristics:

Airplane A: Large wing area (high lift), small tail (less pitch stability), high moment of inertia (less maneuverable).

Airplane B: Smaller wing area (lower lift), larger tail (more pitch stability), lower moment of inertia (more maneuverable).

Airplane A might be more fuel-efficient due to its high lift wing, but it could be less responsive to pilot inputs and require more anticipation to maintain stability in turbulence.

Airplane B, with its smaller wing, might require more power to maintain altitude, but its larger tail and lower inertia would make it more responsive and maneuverable.

This example highlights the trade-off between different design parameters for achieving stability

How it is possible to Earn Money Using the Knowledge of Aircraft Stability Calculations in our real world ??????

There are several ways to leverage your knowledge of aircraft stability calculations and turn it into income in the real world.

Here are a few options:

1. Aerospace Engineering:

This is the most direct path. Many aerospace engineering roles involve designing, analyzing, and testing aircraft. Your expertise in stability calculations would be highly valuable in ensuring safe and efficient aircraft designs.

You could work for:

Aircraft manufacturers: Designing new aircraft models and performing stability analyses.

Government agencies: Contributing to aircraft certification processes and safety regulations.

Consulting firms: Providing stability analysis services to aircraft operators or manufacturers.

2. Flight Test Engineering:

Flight test engineers plan, conduct, and analyze flight tests to evaluate aircraft performance and stability characteristics. Your knowledge of stability calculations would be crucial for interpreting flight test data and ensuring the aircraft meets stability requirements.

3. Freelance Consulting:

Offer your expertise as a freelance consultant to smaller aviation companies, drone manufacturers, or startups developing novel aircraft designs.

You could specialize in specific areas like:

Developing custom software tools for stability calculations.

Providing stability analysis for existing aircraft modifications.

Consulting on drone stability and control systems.

4. Instructional Roles:

Share your knowledge by teaching aircraft stability and control courses at:

Aviation schools: Training future pilots on aircraft stability principles.

Universities: Educating aerospace engineering students on stability calculations.

Online platforms: Create and deliver online courses on aircraft stability for a global audience.

5. Develop Educational Resources:

Package your knowledge into educational materials like:

E-books: Explain aircraft stability concepts in an accessible way for pilots or enthusiasts.

Online tutorials: Create video tutorials or interactive simulations to teach stability calculations.

Mobile apps: Develop mobile applications that perform basic stability calculations for pilots or students.

By leveraging your expertise in aircraft stability calculations, you can establish yourself as a valuable asset in the aviation industry and generate income through various means.

Do YOU Want To Earn Money In Various Ways, Click The Link & Explore Your Field of Interest!!!

Airfoil Analysis Calculator:Calculators for Students, Engineers & Researchers:free Online Tool

Airfoil Analysis Calculator

Center of Gravity Calculator:Calculators for Students, Engineers & Researchers:free Online Tool

Center of Gravity Calculator

Lift and Drag Calculator:Calculators for Students, Engineers & Researchers:free Online Tool

Lift and Drag Calculator

Thrust Calculator:Calculators for Students, Engineers & Researchers:free Online Tool

Thrust Calculator

Wing Design Calculator:Calculators for Students, Engineers & Researchers:free Online Tool

Wing Design Calculator

Aircraft Performance Calculator:Calculators for Students, Engineers & Researchers:free Online Tool

Aircraft Performance Calculator

Sunday, 25 June 2023

Cost of Capital Calculator:Calculators for Students, Engineers & Researchers:free Online Tool

Definition:The Cost of Capital refers to the cost a company incurs in order to finance its operations through various sources such as equity and debt. It represents the minimum return that investors expect from providing capital to the company. The Cost of Capital is typically expressed as a percentage and is used in financial decision-making processes such as capital budgeting and investment analysis.

Click the Translate button(see right) on this post to set your Own Language to understand more perfectly!!

Cost of Capital Calculator

The Cost of Capital can be calculated using the weighted average cost of capital (WACC) formula, which considers the proportion of equity and debt in the company's capital structure, as well as the cost of equity and cost of debt.

The formula is as follows:

WACC=𝐸𝑉×Cost of Equity+𝐷𝑉×Cost of Debt×(1−Tax Rate)

WACC= VE ×Cost of Equity+ VD×Cost of Debt×(1−Tax Rate)

Where:

E = Market value of the company's equity

D = Market value of the company's debt

𝑉=𝐸+𝐷

V=E+D = Total market value of the company's financing (equity + debt)

Cost of Equity

Cost of Equity = Return required by equity investors

Cost of Debt

Cost of Debt = Cost of borrowing for the company

Tax Rate

Tax Rate = Corporate tax rate

Versatile uses of the Cost of Capital include:

Capital Budgeting: Companies use the Cost of Capital to evaluate investment opportunities and decide whether to undertake projects or investments. Projects with expected returns higher than the Cost of Capital are typically accepted.

Valuation: The Cost of Capital is used in various valuation models such as discounted cash flow (DCF) analysis to determine the present value of future cash flows. It serves as the discount rate applied to future cash flows to calculate their present value.

Capital Structure Decisions: Companies use the Cost of Capital to optimize their capital structure by determining the appropriate mix of equity and debt financing. This helps in minimizing the overall cost of capital and maximizing shareholder value.

Performance Evaluation: The Cost of Capital is used to evaluate the performance of a company's management in generating returns for shareholders. A company that consistently earns returns higher than its Cost of Capital is considered to be creating shareholder value.

Merger and Acquisition Analysis: The Cost of Capital is used in evaluating potential mergers, acquisitions, or divestitures. It helps in assessing the financial impact of such transactions on the combined entity's cost of capital and overall value.

Ways to utilize the Cost of Capital to earn money include:

Optimizing Investment Decisions: By comparing the expected returns of investment opportunities with the Cost of Capital, companies can prioritize projects that offer the highest return on investment, thereby maximizing profitability.

Strategic Financial Planning: Companies can use the Cost of Capital to develop financial strategies that minimize their overall cost of capital while balancing risk and return. This may involve refinancing debt, issuing new equity, or restructuring existing financing arrangements.

Attracting Investors: Demonstrating a lower Cost of Capital relative to competitors can make a company more attractive to investors, leading to higher stock prices and increased access to capital markets.

Negotiating Financing Terms: Understanding the Cost of Capital enables companies to negotiate favorable terms on financing arrangements such as loans, bonds, or equity issuances. This can result in lower borrowing costs and reduced financial risk.

Improving Shareholder Value: By effectively managing their Cost of Capital, companies can enhance shareholder value by generating higher returns on invested capital and increasing earnings per share.

Overall, the Cost of Capital is a critical financial metric that influences various aspects of corporate decision-making and can be leveraged strategically to enhance profitability and shareholder wealth.

Do YOU Want To Earn Money In Various Ways, Click The Link & Explore Your Field of Interest!!!

IRR Calculator:Calculators for Students, Engineers & Researchers:free Online Tool

Definition: The Internal Rate of Return (IRR) Calculator is a financial tool used to determine the rate of return at which the net present value (NPV) of cash flows from an investment equals zero. In simpler terms, it calculates the annualized effective compounded return rate that an investor can expect to earn from an investment over its lifespan.

Click the Translate button(see right) on this post to set your Own Language to understand more perfectly!!